Heating cable prices in Europe are influenced by a complex interplay of factors, which can be categorized as follows:

1. Production Costs

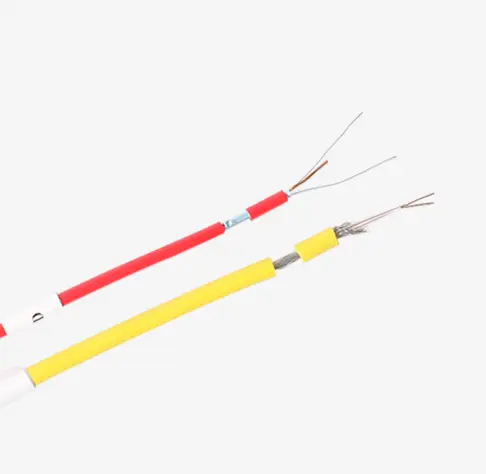

- Raw Materials: Prices of metals (e.g., copper, nickel) and insulation materials (e.g., plastics derived from oil) fluctuate based on global commodity markets. For instance, rising copper prices directly increase manufacturing costs.

- Energy Costs: European energy volatility, exacerbated by events like the Russia-Ukraine conflict, impacts production expenses, especially for energy-intensive manufacturing processes.

- Labor Costs: Higher wages in Europe compared to manufacturing hubs like Asia can elevate prices, though imported goods may mitigate this depending on trade dynamics.

2. Economic and Trade Policies

- Tariffs and Import Duties: EU trade policies, such as anti-dumping duties on imports (e.g., from China), can raise costs for foreign-made heating cables.

- Currency Exchange Rates: A weaker euro against currencies like the USD or CNY increases the cost of imported materials or finished products.

3. Regulatory Environment

-Standards Compliance: EU regulations (e.g., RoHS, REACH) mandate safety and environmental standards, potentially requiring costlier materials or processes.

- Environmental Incentives: Subsidies for energy-efficient products (e.g., self-regulating cables) may lower consumer prices, while carbon taxes could raise production costs.

4. Market Dynamics

- Competition: A competitive market with multiple suppliers can suppress prices, whereas oligopolistic markets may lead to higher pricing.

- Technological Innovation: Advances (e.g., smart heating systems) may introduce premium pricing, though economies of scale could eventually reduce costs.

5. Demand-Supply Factors

- Seasonal Demand: Winter spikes in demand for heating solutions can drive short-term price increases.

- Infrastructure Projects: Growth in renewable energy systems or electric heating adoption may boost long-term demand.

6. Logistics and Supply Chain

- Transportation Costs: Global disruptions (e.g.,Canal blockage) affect shipping expenses and lead times.

- Supply Chain Complexity: Multiple intermediaries or regional shortages (e.g., semiconductor chips for smart cables) add markups or delays.

7. Geopolitical and Macroeconomic Factors

- Crises and Conflicts: The energy crisis post-2022 and supply chain bottlenecks from geopolitical tensions directly impact production and distribution costs.

- Inflation: Broad economic inflation in Europe raises input costs, which are often passed to consumers.

8. Substitutes and Alternatives

- Competing Technologies: Cheaper alternatives (e.g., heat pumps) may limit price hikes, though niche applications (e.g., underfloor heating) sustain demand for cables.

Examples in the European Context:

- The 2022 energy crisis spiked manufacturing costs due to soaring natural gas prices.

- EU’s push for decarbonization (e.g., Fit for 55) drives demand for electric heating solutions, influencing cable pricing.

- Stricter efficiency standards under the Ecodesign Directive may necessitate costlier, high-performance products.

In summary, heating cable prices in Europe are shaped by a blend of material costs, regulatory pressures, market forces, and external shocks, all interacting within the region’s unique economic and geopolitical landscape.